This post will take a quick look at the performance of the client's portfolio from week 4 to week 8 in order to see how effective the mean-variance optimization approach has proven. Also the structural effects of the changes made in week 8 will be summarized (see the previous post about forecasting interest rate changes for the rationale behind these new changes).

Graphed below is the portfolio performance against the benchmark over the past 4 weeks:

Again, we are seeing highly comparable performance to that of the benchmark. A positive note to mark however is that instead of slight under-performance as in the first 4 weeks, there is now slight over-performance in this period. The return of the clients portfolio was 2.44%, compared to the 2.15% return of the benchmark index.

Overall, this seems like a good sign that the optimization of the portfolio has led to more fine-tuning of performance relative to the benchmark. It will be interesting to see once data up to 12 weeks is collected, how the performance is attributed by Bloomberg.

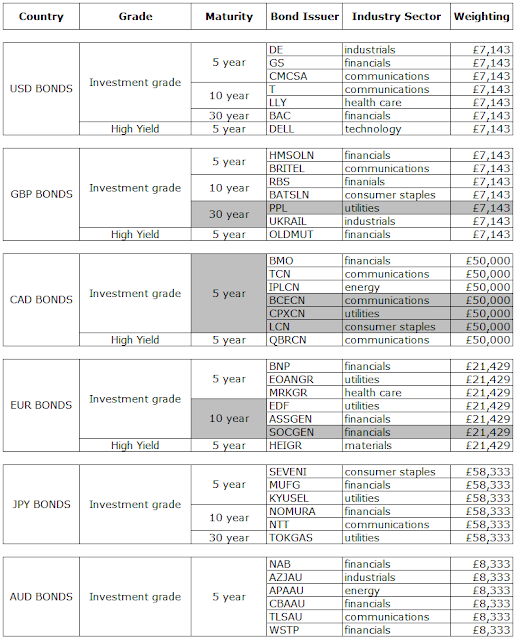

In the mean-time, here are the most recent changes made in week 8:

(Structural changes have been shaded in grey)

Overall, the average maturity of bonds in the portfolio has decreased. This is no surprise, as the active changes have been made in order to target changes in duration.

Looking at characteristics on a country level shows that modified duration of the Canadian segment has been dramatically decreased (now 5.05 from 9.86), the Euro segment has been decreased moderately (now 6.97 from 9.34) and the UK segment has been increased moderately (now 11.60 from 8.64).

--

No comments:

Post a Comment